Trading Psychology and why it should matter to you.

I've recently come across the topic of trading psychology, thanks to a couple of my close friends.

One of them shared the video below and I'd like to share with you key areas I learned from it.

Controlled Elements in Trading:

Your analysis

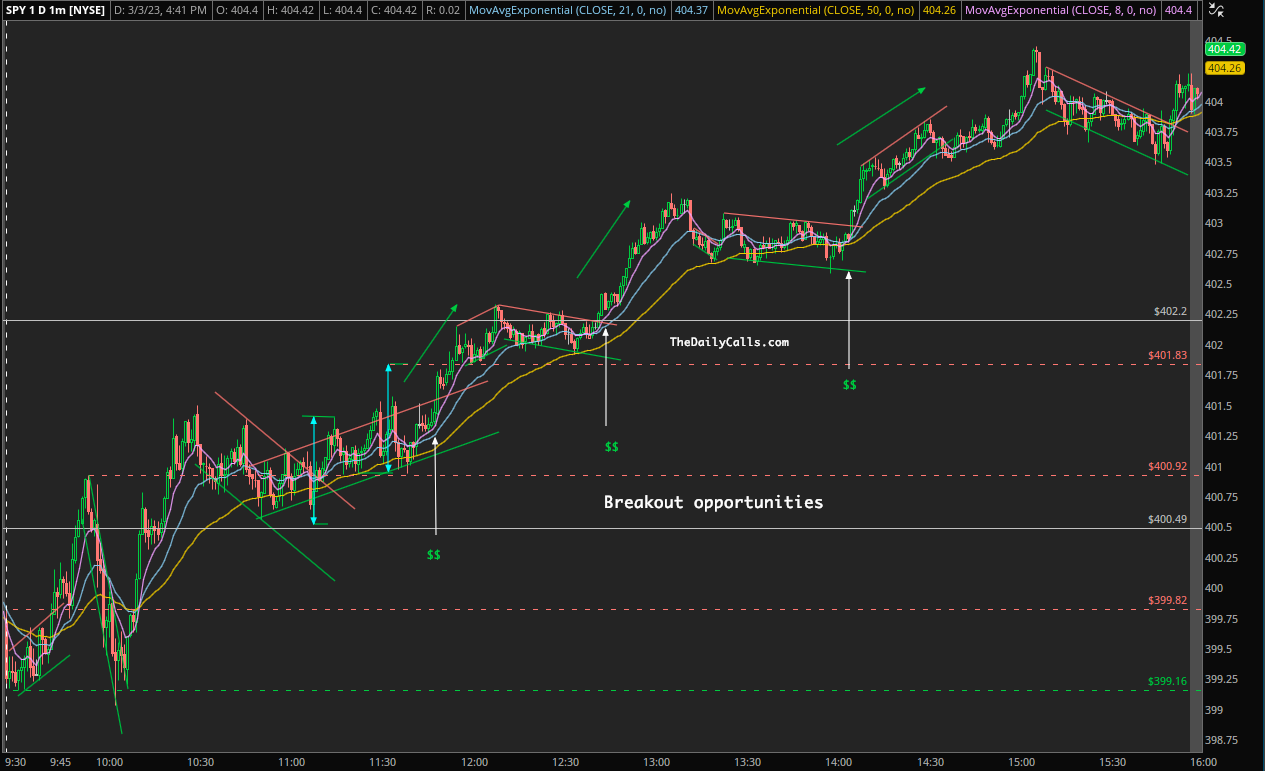

Before the start of the session, I review the structure of the pre-market; I deduce if it's bullish or bearish (or sometimes, trading range). I mark key levels that I believe the traders may choose to retrace later.

Timing the entry and exit

At the beginning of the session, I wait patiently while I observe the price action. Albeit I do not trade in the 1-minute timeframe, I do identify channels in it. I find this helpful to deduce diagonal support and resistance key levels. The first 30-minutes of the session is generally helpful in plotting the early key levels and trendlines.

In addition to key levels, I use other elements to form a confluence to hep me decide when to enter the trade. This includes looking at the VIX and $VOLD charts.

Market and Time Frame

I day trade the S&P500 SPY ETF options in the 5-minute timeframe while using 15 and 30-minute as guidance. Although different traders have their own preference, I trade 0dte before 11 A.M. EST. I am not a proponent of 0dte options trading if you are in the early stages of your trading journey.

I do not use a lot of indicators. That said, I only use the 3 exponential moving average (EMA), 8-21-50. My key EMA is the 21-ema. I use it to deduce if market has bullish or bearish sentiment. I observed the price tend to generally use these EMA as key levels.

Trading is a game with your own rules. A game of pyschology and discipline. Numbers, analysis, and data are secondary.

Risk-Reward (Risk Management)

In trading, patience is key. I buy at key levels that I deduced to have higher probability of moving in the direction of the market. We should not blindly go in any trade and much worse without a stop loss set.

We have different risk appetites. The key is to pick one and stick with it. Be it 1-1 or 1-2 risk reward ratio, you need to be consistent.

Before I hit that send button, I have a price target and stop loss set. This is why I trade in the 5-minute timeframe. It provides me the time to define my position size, entry/exit target, and stop loss. I'll talk more on position sizing in the next section.

Position Sizing

I use 1% of my portfolio when deciding on the position size of my order. This provides me with the number of contracts that I can order that fits my risk appetite. When I was in my early stage of my trading journey, this topic was a bit blurry. As I gained experience, it helped me understand this more.

If you are like me, post your questions in the comments below and I'll help you on this topic.

Major Economic Releases

I do not trade equities asset type (stocks) as often as financial derivatives (calls and puts contracts). That said, if you have investments in the equities, you need to deduce the path you will take for your exposure. Major economic events tend to inject higher volatility in the market. If you haven't experienced this, watch the SPY market during FOMC meeting minutes release or Consumer Price Index release events.

Trade Management

After I hit that send order button, I let the setup play out. I do not move my price target or my stop loss. This is one my own personal rules I adhere to. You need the discipline to sit on your hands while you're in the trade and stick with the plan.

You may already have a profitable trading strategy in your hands, you just don't know it because after every losing trade, you change it or you want to adjust it so that the loss just took could have been avoided.

If you find this article helpful, let's continue the conversation in the comments below. Maybe share your own experience and strategies for all of us to learn from each other. Cheers.

You only lose if you don't have a stop loss. Cheers Traders.

— Rocketman

I am not a professional investment adviser and my opinions are based on my own technical analysis. Please consult an investment professional before making investment decisions.

Do your due diligence if or when placing a trade. All ideas stated here are my own and do not represent trading or investment advice.

Member discussion