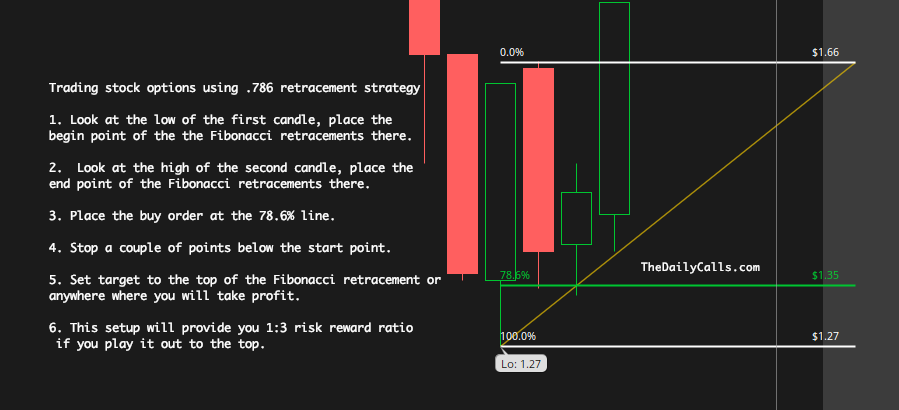

Trading stock options using the .786 Fibonacci Retracement

Bello Traders.

As most of you know, I invariably trade the S&P500 ETF Trust (SPY). I use different tools to help me with the decisions I have to make before I hit that send button. I use ThinkOrSwim platfrom from TD Ameritrade.

Recently, I've come across a strategy using a tool I've known for a while but have not put to much use. That is the Fibonacci Retracements.

The premise is to use the 78.6% line as your entry point. Of course, there are other considerations before you commit to that order. There's the market structure, the major key levels, etc. The point is, you should have done your due diligence by the time you hit the send order button.

I started using this strategy today and I've had good results with it. The steps are listed below.

This strategy will require you have the discipline to wait for the price to come to you and not force it. If you miss the fill, do not worry. There are other opportunities. Do not chase.

In case you have questions, hit me up in the comments section or shoot me via email if you get this thru our newsletter. Use this is a guide for educational purposes only.

You only lose if you don't have a stop loss. Cheers Traders.

— Rocketman

I am not a professional investment adviser and my opinions are based on my own technical analysis. Please consult an investment professional before making investment decisions.

Do your due diligence if or when placing a trade. All ideas stated here are my own and do not represent trading or investment advice.

Member discussion