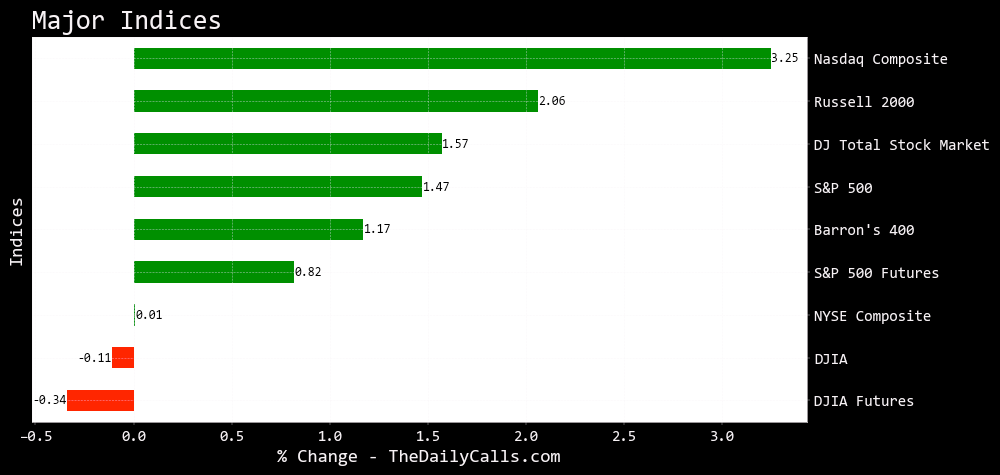

Nasdaq up 3.25%, Meta at pole with 23.28% gains after their earnings results

Heya heya heya Traders!

The tech-heavy Nasdaq pretty much dominated the grid today. Let's set aside the 3 As for a second, the party pooper. Stocks like Microsoft, Meta, Nvidia, and PayPal were all riding the wave.

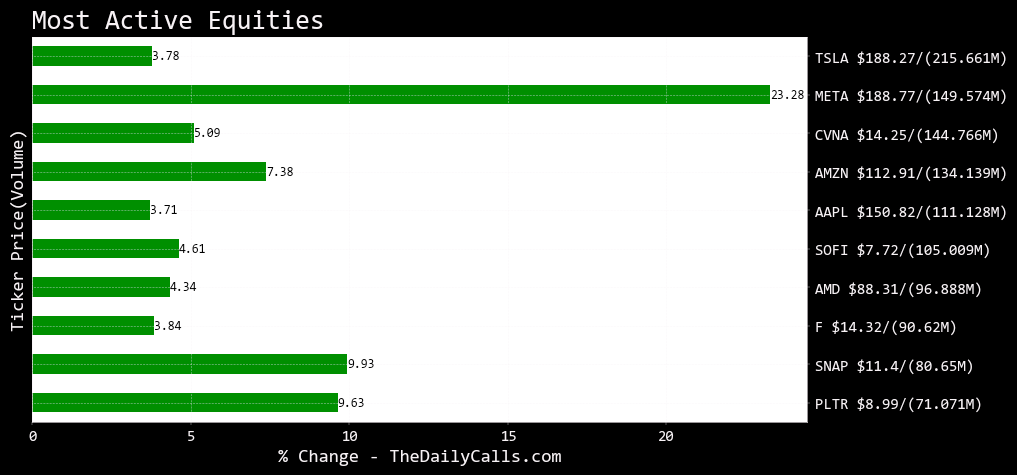

Meta was caught speeding with their 23.28% gains after the bell.

While Apple, Amazon, and Alphabet were trending higher before the bell rang, the after hours were a different story. All of their earnings were, how should I put it, not so good. After the bell, Apple was trading -3.87%, Amazon at -5.22%, and Alphabet at -3.89%.

Let's just treat tomorrow as an opportunity to get these premium stocks at a discount. Not a recommendation.

Another worth noting today, was how the VIX was trending higher as the SPY was doing the same. Not sure what happened there but I thought it was crazy.

It was a very good day to be trading calls today and some puts towards the tail end. Tomorrow may be a different story. Will the 3 As earnings dampen the mood? Tune in here tomorrow to find out.

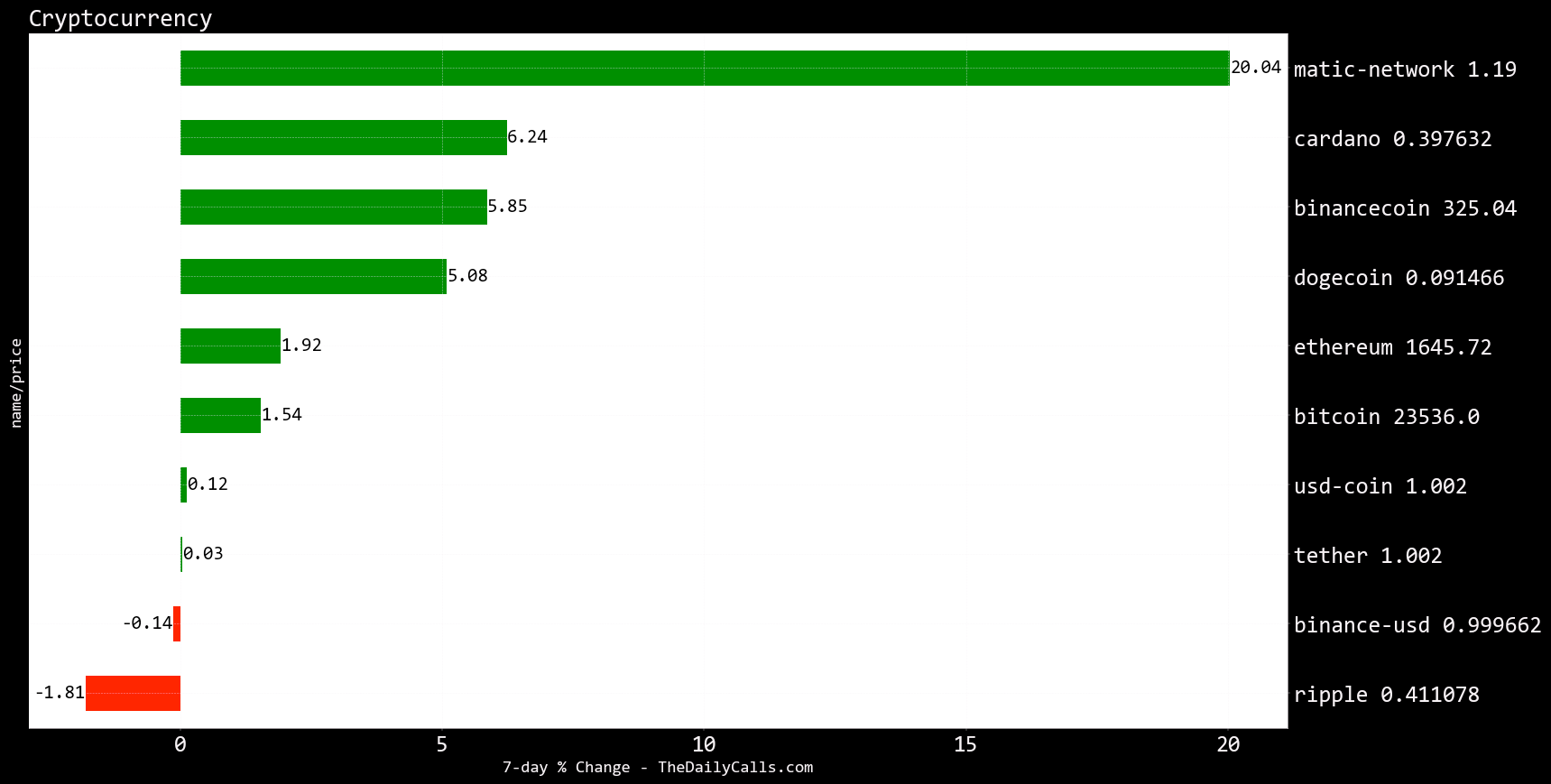

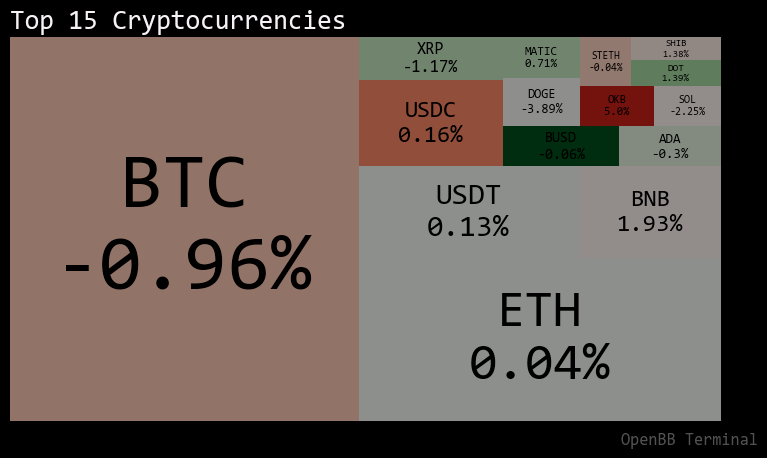

Bitcoin is at 23,562 at the moment.

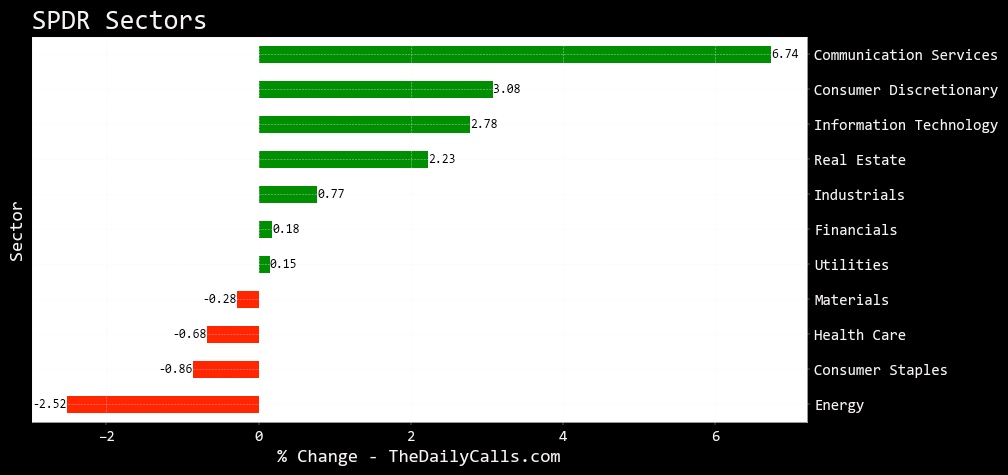

Energy just can't get out of the end zone and seems to be enjoying the last one at the grid. Communication Services leads the sectors with 6.74% gains. Oh, I almost forgot, do you know who was pushing Energy at the back? It's Down Jones Industrial Average. They didn't seem to get the memo, down -0.11% and the only one red after the bell.

Tomorrow's earnings include Cigna, Regeneron, Aon, Saia, and Sanofi.

You only lose if you don't have a stop loss. Cheers Traders.

Most Active Equities

Market Performance

Sector Performance

Cryptocurrency Performance

I am not a professional investment adviser and my opinions are based on my own technical analysis. Please consult an investment professional before making investment decisions.

Do your due diligence if or when placing a trade. All ideas stated here are my own and do not represent trading or investment advice.

Member discussion