Daily Observations 07 January - SPY closed lower than 155-day SMA

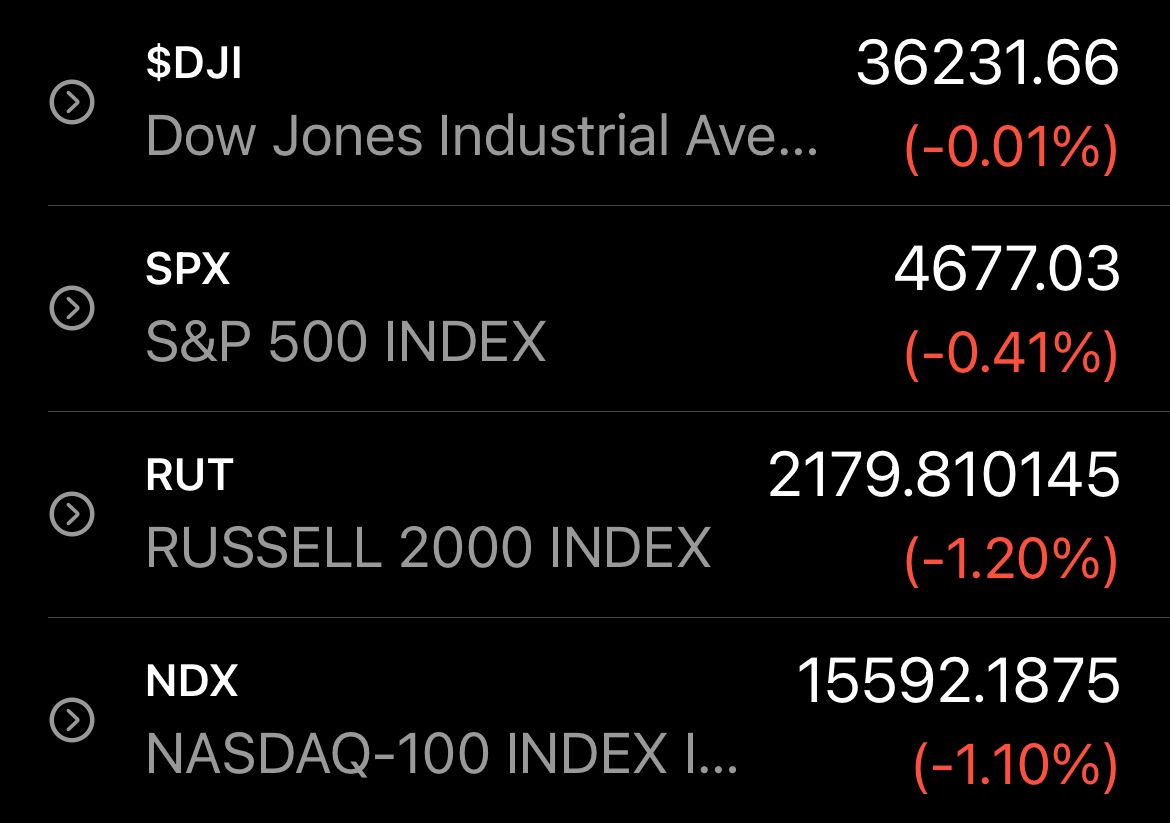

Reds still rule the day. $DJI -0.01% | $SPX -0.41% | $RUT -1.20% | $NDX -1.10%

$SPY lower than the 155-day SMA

$DJI -0.01% | $SPX -0.41% | $RUT -1.20% | $NDX -1.10% | $VIX -4.33%

Market Performance

Sector Performance

- For the second day, 6 of 11 sectors finished red today.

- Best sector: Energy leads again and added 1.37% to 61.34 (60.50 prev).

- Laggard sector: Consumer Discretionary down 1.67% to 199.48.

- VIX retreats, it's down 4.33% to 18.76 (19.61 prev).

- Crude oil /CL declines 0.65% to 78.94 (79.56 prev).

- TNX up again 2.19% to to 17.71 (17.33 prev).

- TYX gains as well 1.19% to 21.18 (20.93 prev).

SPY Snapshot

- $SPY declines 0.40% closing to 466.09 (467.94 prev). Additionally, closing price is lower than the 9-day EMA of 470.96 and 20-day EMA of 474.04. Yesterday, I asked, "Will it bounce off the 180-day SMA of 466.1?"; it is clinging to its dear life. 180-day SMA today is 466.34.

- Relative strength index dips some more to 41.86 (44.75 prev). This is lower then our 44.66 support marker.

- Volume loosens up a bit more to 84.9M from 85.9M yesterday.

Disclaimer: I am not a professional investment adviser and my opinions are based on my own technical analysis. Please consult an investment professional before making investment decisions.

Member discussion