Trading Options - Call Trades

Long Call Option

Like most of you, I keep a small group of friends that I chat with on a daily basis; mostly on security trades such as stocks. A year ago, a couple of them started talking about options trading. I curiously read through the conversation. At that moment, I was intrigued but not sold yet--no pun intend--as I was happy and content with trading stocks.

A few weeks later, I caved in. I bought my first call option.

The market at the time was bullish; naturally my call value went up and I sold it right away. I was, as you would say, dipping my toes in the water. I was hooked immediately. I started reading more about it; practicing using paper trades; and got certified thru TDAmeritrade's Education offering.

Today, I would like to share with you some key ideas to keep in mind when trading options. In this article, we will focus on a single leg call option order.

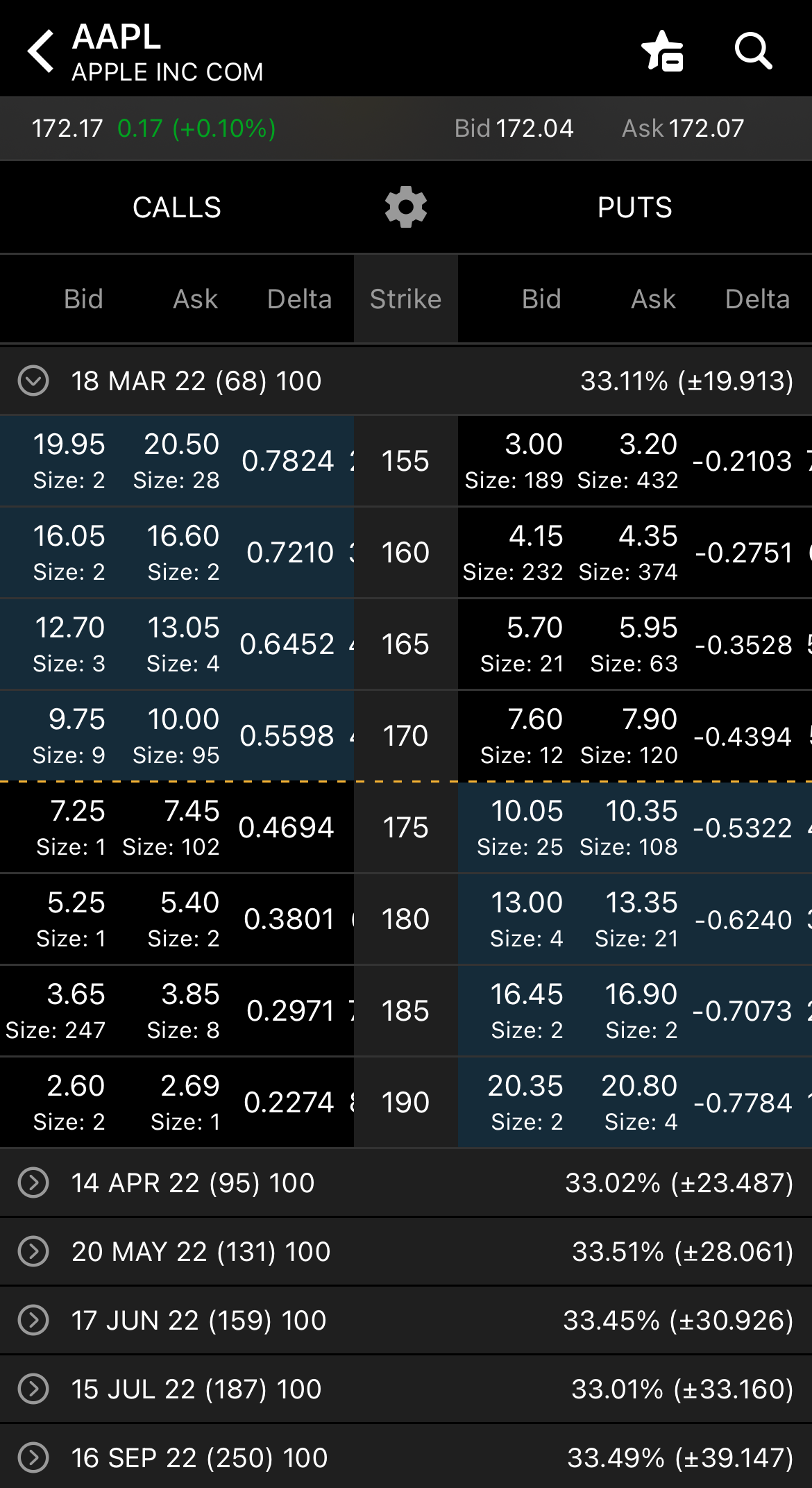

First, I want to take you to some understanding of the option chain. Simply, it's a table of all options of an underlying security--stocks, index, futures, etc.--along with characteristics such as the price, bid, ask, volume, and much more.

Option Chain

- The table is generally split into two sides: the calls and the puts.

- Each side is then grouped by dates, we call this the expiration date.

- The middle column, generally, the strike, is the price of the underlying that represent each row.

- Bid - the premium you get when your intent is to sell the option. You get a credit when you sell the option.

- Ask - the premium you pay when your intent is to buy the option. Generally, on a single-leg option, this is your defined risk.

There is a multitude of characteristics--such as the Greeks--you can add as columns in your table, but for now, I want you to have a good understanding of the basics.

ATM, ITM, and OTM

Another set of definitions you need to learn are the ATM, ITM, and OTM. ATM stands for at the money, ITM is in the money, and OTM is out of the money.

ITM:

- In the money options are those that have strikes that are generally highlighted in the option chain.

- Statiscally, they are the options with delta higher than .51 to .55.

- The higher the delta, some refers to it as deeper in the money.

ATM:

- At the money options are generally those that have strikes closest to the current price of the underlying security.

- Statistically, they are the options with delta equal to .50.

OTM:

- Out of the omey options are generally those that have strikes with delta lower than .50.

- The lower the delta, some refers to it as further out of the money.

The Delta

It is time to introduce you to one of the Greeks, the Delta. The delta can mean a couple of things to an investor. It can be used as the probability of an option expiring in the money. An investor can also use it as a gauge to tell how much the trade will be affected when the underlying security moves a dollar up or down.

Option Activities

Next, let us get started with a couple of activities I'd like you to keep in mind at all times. These are buying and selling a call option.

- When you buy a call option, you have the right--but not the obligation--to buy 100 shares of the underlying security at the strike price on or before the expiration date.

- When you sell a call option, you are obligated to sell 100 shares of the underlying security at the strike price on or before the expiration date.

Different names

An option trade order can have many names; it depends on who you talk to but they generally refer to the same order. The following means the same thing:

Bullish:

- Long call

- Debit call

Bearish:

- Short call

- Credit call

Putting it together

Now that you have an understanding of an option chain, its characteristics, and the two activities you can do with them, let us move on to putting together a single-leg call option trade.

Your defined risk is a percentage of the total dollar amount of your porfolio; the investor can use 1% to start with or half of 1%. For instance, let's say our portfolio starts with 100K. Our defined risk--or max loss--will be 1K or 500, respectively.

If you have a smaller portfolio, there are hundreds of underlying to choose from. I generally start with the SPY stocks.

Once you have selected the underlying security, the next step is to validate it has a bullish bias. When picking the underlying, I perform the due diligence of reviewing the trend of the underlying. This is done thru technical analysis.

The next step is to pick a strike price. Each strike price has different premiums. The higher the delta, the higher the premiums. In my experience, I always keep in mind what my defined risk is.

In my experience, the investor can generally starts with ATM options if it meets the defined risk. The investor can size order accordingly and click on the Ask price. After review that everything is in place, the investor can submit the order.

The investor needs to monitor the open position daily and watch out for wild swings that can affect the trade.

Disclaimer: I am not a professional investment adviser and my opinions are based on my own technical analysis. Please consult an investment professional before making investment decisions.

Member discussion