Trading Options - SPX Credit Spread

Credit Spread Using The SPX

If you found this article, then you are probably interested in learning about credit spreads. You probably have questions about the intricacies of it, how to craft the trade, is it a product for you, and maybe questions around the risk involve. If that's you--or if you do have a bit of experience and just want to learn--then let me try to help explain it for you.

Let me introduce a couple of characters who will help us learn today.

- Bill de Envestor

- Vlad Von Rocksteel

Both of these young lads have known each other for years. They have both been trading securities for a while now. They have a good understanding of options trading. Hobbies include people watching, option chain reading, and collecting passive income.

Credit spreads are classified as passive income.

The goal is for your spread order to expire worthless and you collect the premiums you get when you setup the trade. The underlying price can go up, down, or sideways as long as it does not go higher than your short strike price if you are working with calls. Conversely, the underlying price should not go lower than your short strike price when working with puts.

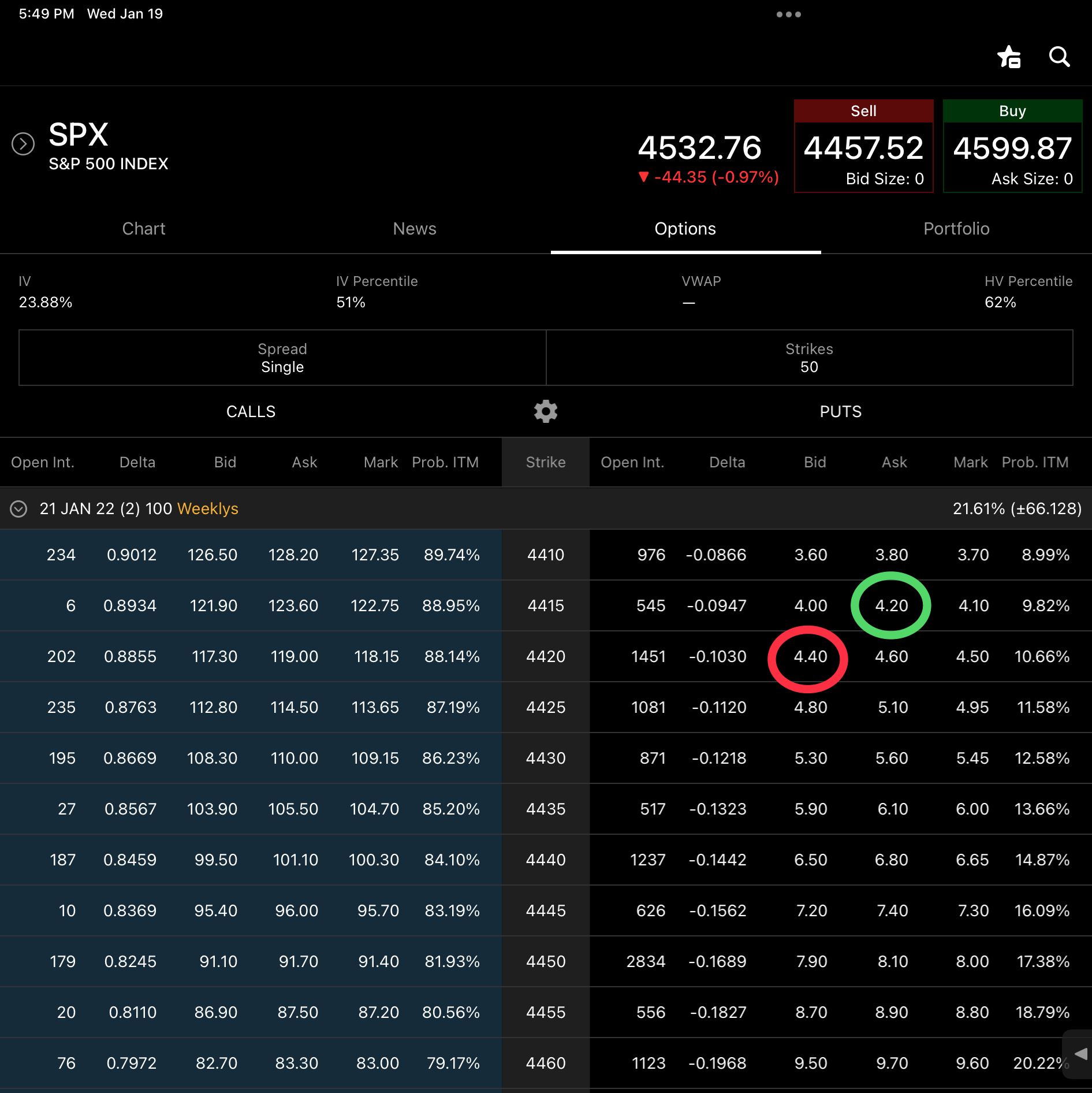

In this article, Bill and Vlad will use the SPX. They are in a cafeteria and it's a Wednesday, it's around 9:50 A.M. Eastern.

Bill: "Good morning, mate. Have you seen the market movement today?"

Vlad: "Yeah man, it's doing another projectile dysfunction. How long will the market stay like this?"

Bill: "I dunno. It's a good thing we can still collect our passive income with SPX."

The SPX is one of the major indices investors use to track the market. Bill and Vlad loves placing weekly credit spreads order for SPX. Similarly, we will use the SPX in crafting our trade order.

Now that we have a financial product that we can use, let's define what a credit spread is in terms of the SPX option chain.

A credit spread is a type of an option trade that is consists of two legs. Generally, you buy and sell contracts of an optionable product like SPX with the same expiration dates. An investor can do this using a call or a put credit spread order .

Vlad: "Bill, when should we use a call or a put in our credit spread order?"

Bill: "Good question, Vlad. What I normally do is look at the trend of SPX. I generally place a put credit spread when I have a bullish bias. And, conversely, I place a call credit spread when I have a bearish bias or neutral."

Let's begin with a call spread. The way an investor craft this order is to sell a call such as the 4625 strike and to buy another call, 4630, that is immediately higher than the previous one. This is a $5 dollar wide spread. The investor will review and submit the order.

It's the same on the put side if the investor like to go that route. The investor will sell the strike, 4420, and buy the 4415 strike on the same order. The investor will review and submit the order.

Vlad: "I noticed you selected the short leg with delta of 0.10."

Bill: "That is right, Vlad. We use the delta to provide us the probability of our short expiring in the money. In our case, there's a 10% probability for it to expire in the money."

Vlad: "Or, from a different view, it means we have 90% chance the short leg will expire out of the money!"

Bill: "That's another way to look at it. But keep in mind, these are probabilities, no certainties."

Vlad: "Got it. What's a good time to place this order?"

Bill: "We can do this after the market opens, about an hour or so. We will select the SPX options that are expiring today. We don't want to overnight this order to avoid risk of waking up the next day with news that can affect the volatility of SPX."

Vlad: "Do we need to wait for the day to end to close our order?"

Bill: "We can wait it out or we can close it once we get 50% or 60% of the premium we got. We should always have a plan like this. Also, we need to come up with a stop loss for this."

Vlad: "Stop loss?"

Bill: "Yeah, mate. Don't leave home without it. Since a credit spread is a high probability trade that has low return and higher risk, let's agree to setup our stop loss as two to three times our target dollar amount."

Vlad: "Ok, let me see if I get the play here. If we get a premium of 0.50, our price target to buy it back is 0.25 if we're targetting 50%. Additionally, our stop loss should be two times of the premium which is 1.00. We will risk 0.50 to get 0.25. That's 1.00 less the 0.50 premium we get."

Bill: "Keep in mind, Vlad, that this is a high probability trade. If we time it right, we increase that probability."

Like all things in trading, timing is everything.

So, there you go folks. I hope you learn something new today. This article is for educational purposes only. The examples used are not recommendations. Always remember, these are all probabilities and no certainties. Cheers.

Disclaimer: I am not a professional investment adviser and my opinions are based on my own technical analysis. Please consult an investment professional before making investment decisions.

Member discussion