Daily Observations 14 December

Are we entering bearish town? Read on as we study the red market today.

I'm not sure about you, but I went grocery shopping this afternoon to calm down. Market tumbles pretty much the entire day before recovering a tiny bit towards closing.

Day two of investors selling. $SPY is below its exponential and simple moving averages. What does that tell you? Pop open that bottle of wine because Santa ain't coming soon.

Will we see a cross over of the 9 over 20 exponential moving average soon?

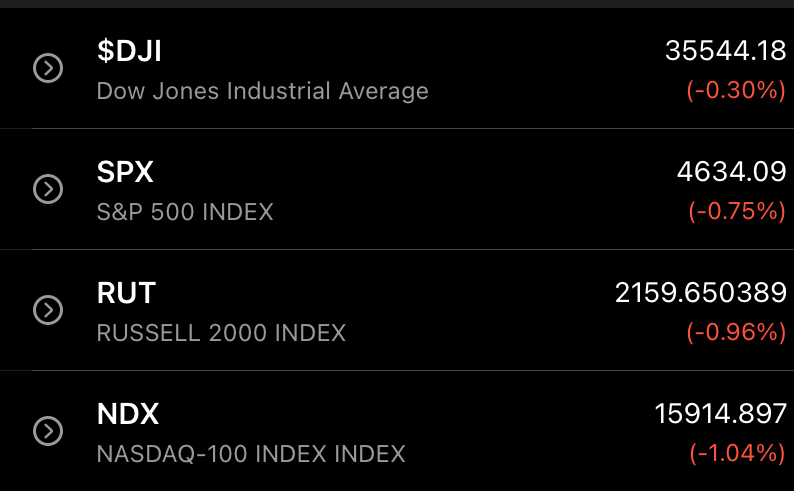

Market Performance

Sector Performance

- Today: 2 of 11 sectors are up.

- Yesterday: 4 of 11 sectors were up.

- Today's best: Financials XLF up 0.75% to 38.86.

- Yesterday's best: Real Estate XLRE up 1.38% at 49.85.

- Today's worst: Technologies XLK down 1.64% to 169.45.

- Yesterday's worst: Energy XLE down 2.78% at 55.65.

- VIX is up 7.78% today to 21.89 compared to yesterday's 8.67% up at 20.31.

- Crude oil /CL is down 0.62% at 70.29.

- TNX is up 0.98% to 14.38.

- TYX is up 0.33% to 18.18.

SPY Snapshot

- SPY took a nose dive today dipping all the way down at 460.25 before recovering at 463.36.

- SPY is below the 9 and 20 day exponential average. 30-day simple moving average is also higher than today's close.

- Relative strength index dips to 49.14 from yesterday's 53.77.

- Volume is trending higher for the second day.

Market Climate

Disclaimer: I am not a professional investment adviser and my opinions are based on my own technical analysis. Please consult an investment professional before making investment decisions.

Member discussion