Daily Observations 26 January - Feds meeting notes rattled the market

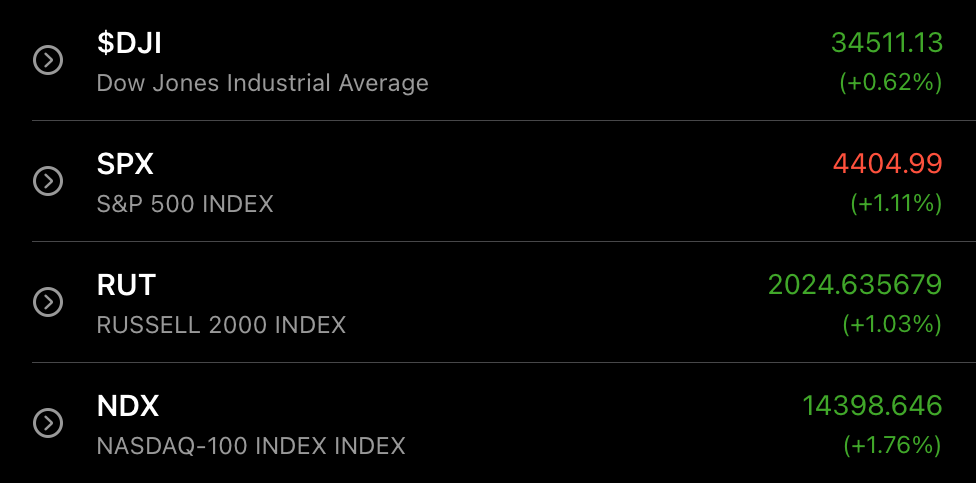

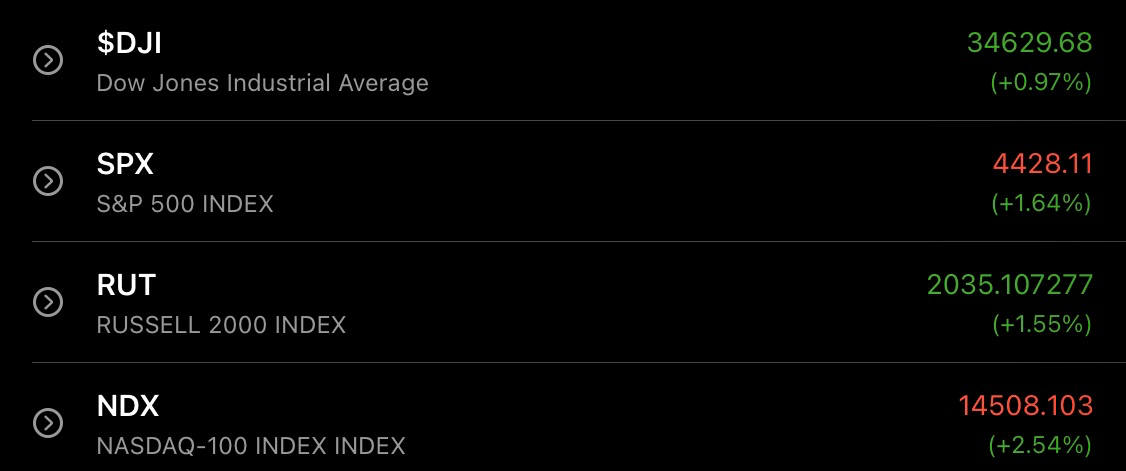

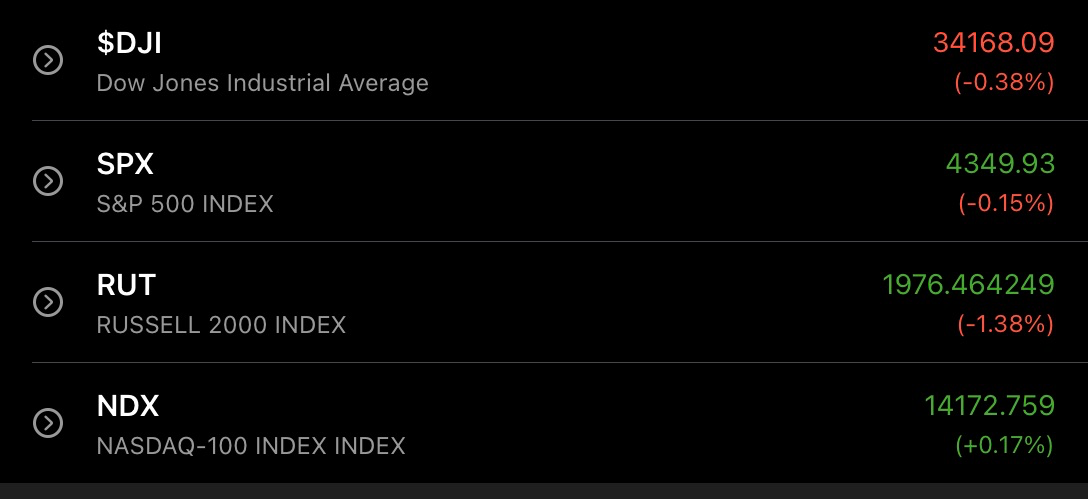

What a roller coaster ride today. Another reversal at mid-day. Technology sector gains half a point percentage. $DJI -0.38% | $NDX +0.17% | $RUT -1.38% | $SPX -0.15% | $VIX +2.57%

What a roller coaster ride today. Another reversal at mid-day.

Technology sector gains half a point percentage. $DJI -0.38% | $NDX +0.17% | $RUT -1.38% | $SPX -0.15% | $VIX +2.57%

Market Performance

Sector Performance

- 2 of 11 sectors finished green today.

- Best sector: Technology gains 0.50% to 152.30.

- Laggard sector: Real Estate slid 1.66% to 46.08.

- VIX gains 2.57% to 31.96 from 31.16.

- Crude oil /CL gains 1.76% to 87.11 from 85.23.

- TNX gains 3.65% to 18.48 from 17.83.

- TYX gains 1.78% to 21.67 from 21.29%.

SPY Snapshot

- $SPY slid 0.25% to 433.38 from 434.47.

- 10-day EMA at 445.65 | 20-day EMA at 454.93 | 180-day SMA 463.65.

- Relative strength index moved down to 17.87 from 18.45.

- Volume gains to 184.35M from 163.34M.

Week 4 Earnings:

- 24 January: HAL, IBM, LOGI

- 25 January: AXP, GE, IVZ, JNJ, LMT, MMM, NEE, RTX, VZ, COF, MSFT, TXN

- 26 January: ADP, ANTM, BA, FCX, KMB, T, CCI, DRE, INTC, LRCX, LVS, NOW, STX, TSLA, WHR, XLNX

- 27 January: ALK, CMCSA, DHR, DOW, FLWS, LUV, MA, MCD, MO, NUE, SAP, SHW, TROW, XEL, AAPL, MDLZ, TEAM, V, WDC, X

- 28 January: CAT, CL, CVX, PSX

Disclaimer: I am not a professional investment adviser and my opinions are based on my own technical analysis. Please consult an investment professional before making investment decisions.

Member discussion