Down is the new black. Markets down again - Daily Observations 23 February

Down is the new black. Markets down again.

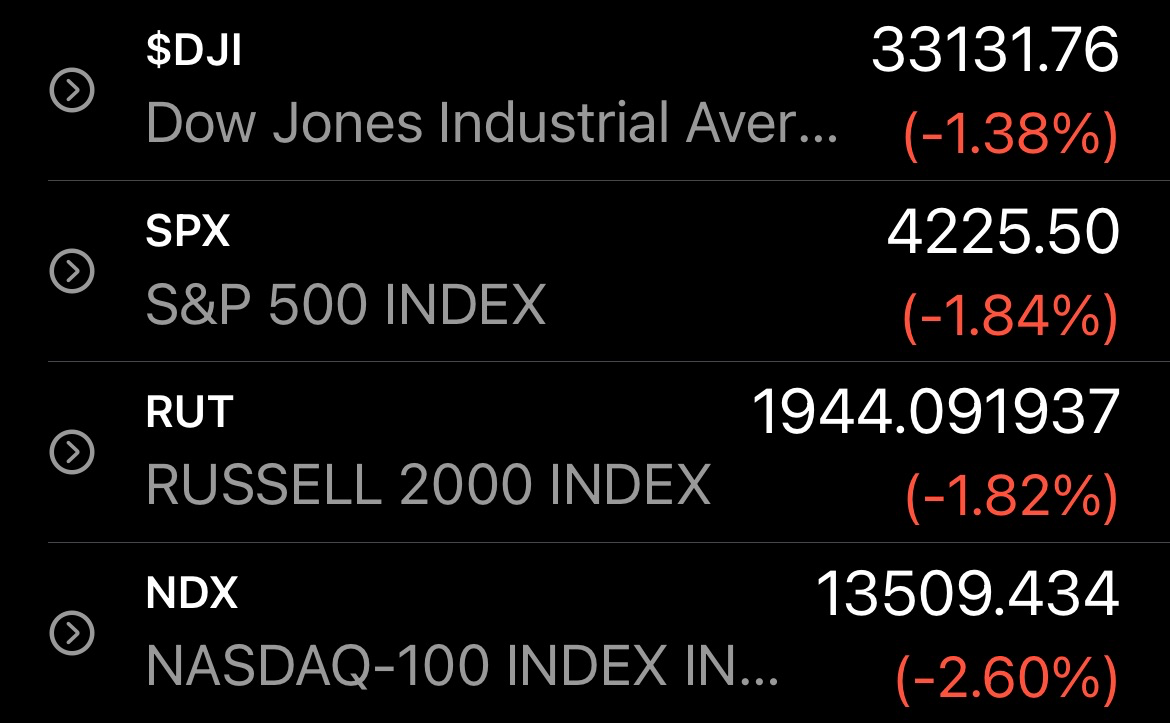

$DJI -1.38% | $NDX -2.60% | $RUT -1.82% | $SPX -1.84% | $VIX +7.67%

- Ebay down 7% after earnings.

- All S&P500 sectors are down except for Energy.

- SPX down to 4220's which seemed unlikely a few weeks ago.

- Earnings tomorrow: Baba, Moderna, Coinbase

Market Performance

Sector Performance

- Only the Energy sector is green today.

- Best sector: Energy gains 1.07%.

- Laggard sector: Consumer Discretionary -3.34%.

- VIX gains 7.67% to 31.02 from 28.81.

- Crude oil /CL slid 0.04% to 92.31 from 92.35.

- 10-year Treasury Yield up 1.49% to 1.98 from 1.95.

- 30-year Treasury Yield up 0.98% to 2.28 from 2.25.

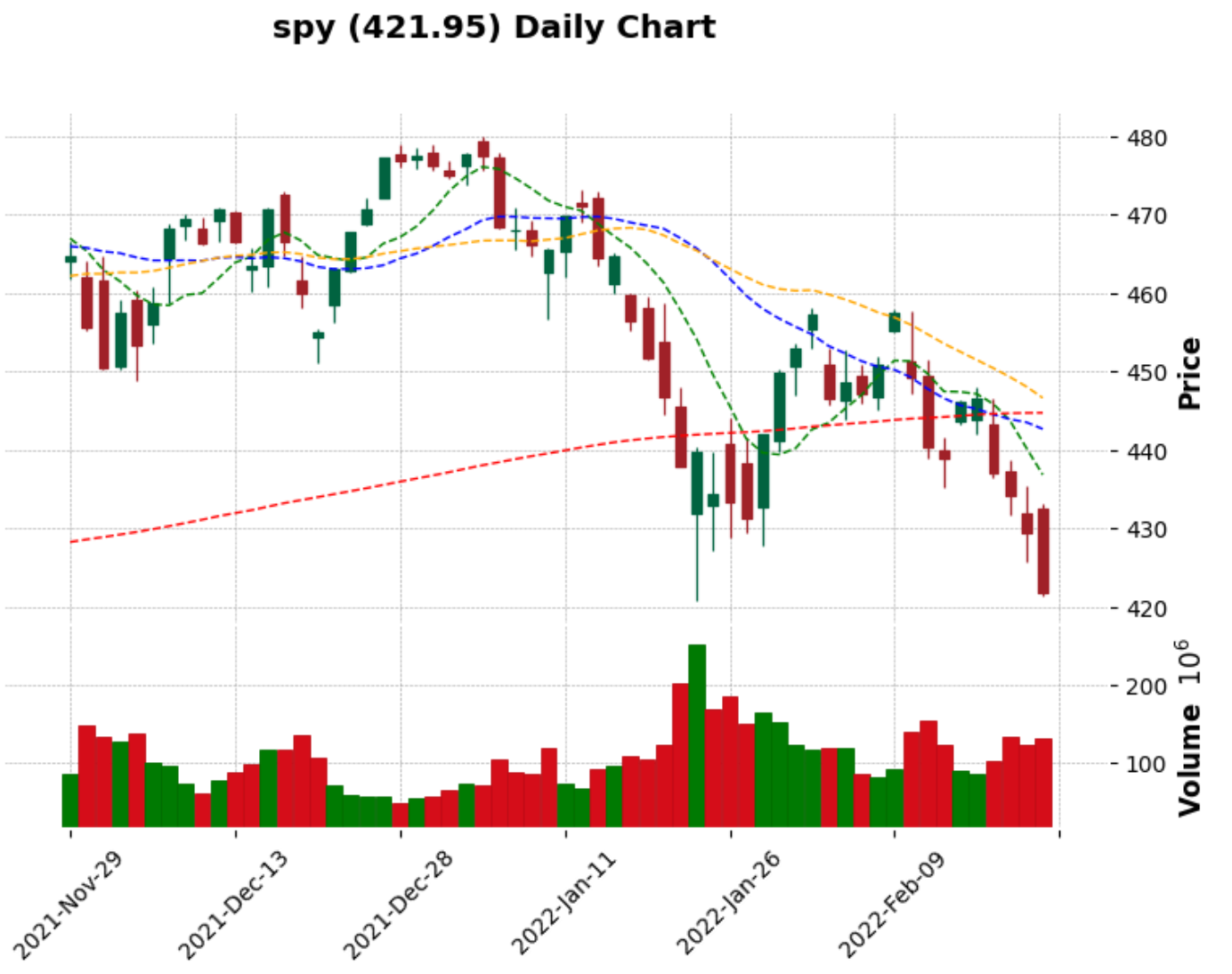

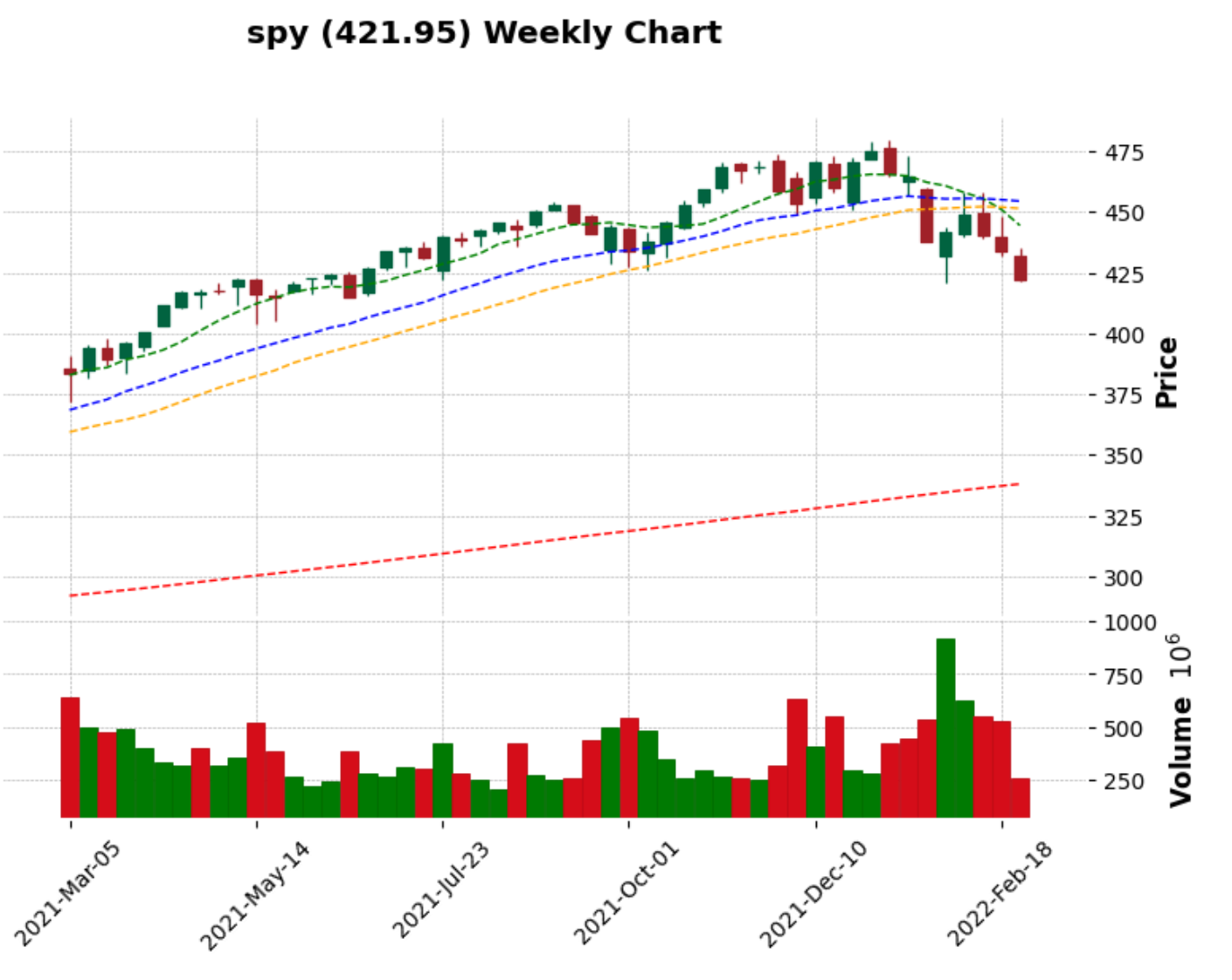

SPY Snapshot

- $SPY slid 1.77% to 421.95 from 429.67.

- 8-day SMA at 436.87 | 21-day SMA at 442.70 | 30-day SMA 446.65 | 200-day SMA 444.76.

- Relative strength index slid to 35.76 from 38.72.

- Volume slid to 117.85M from 124.39.

Week 8 Earnings:

- 21 February: SSL | APA WMB

- 22 February: DNUT HD HSBC M | A PANW SPCE

- 23 February: IHRT JACK OSTK TAP | BIRD BKNG EBAY HTZ NTAP

- 24 February: AMT BABA DISCK DOCN KDP MRNA NKLA SIX W | COIN CVNA ETSY INTU MNST OXY PING VMW ZS

- 25 February: FL NOG TREE

💡

Disclaimer

I am not a professional investment adviser and my opinions are based on my own technical analysis. Please consult an investment professional before making investment decisions.

Do your due diligence if or when placing a trade. All ideas stated here are my own and do not represent trading or investment advice.

Member discussion